What Is Interest? A Home Loan Basic Explained

Table of Content

If you need to buy a house soon, waiting for an ideal market to come about again may not always be realistic. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage.

Let’s say a buyer wants to borrow $400,000 and qualifies for a 30-year fully amortized mortgage at an interest rate of 5%. The buyer decides they want to lower their interest rate for the first 3 years with a buydown. In this scenario, the buyer would pay an interest rate of 2% the first year, 3% the second year and 4% the third year but would have to pay the full 5% from years 4 – 30. The buyer would save approximately $8,380 in interest, so the buyer should expect the total cost of the 2-1 buydown to be in that same ballpark. A 2-1 buydown also provides a buyer with a discounted interest rate, but only for the first 2 years of the loan’s term.

Have a Question or Want a Free Market Report?

Though mortgage rates were historically low at the beginning of 2022, they have been rising steadily since. The Federal Reserve recently raised interest rates by another 0.50 percentage points in an attempt to curb record-high inflation. The Fed has raised rates a total of seven times this year, but inflation still remains high.

Fannie Mae predicts $2.72 trillion in mortgage originations in 2021 and $2.47 trillion in 2022. They anticipate purchase volume to go from $1.53 trillion in 2020 to $1.6 trillion in 2021 and $1.64 trillion in 2022. To calculate your breakeven point, simply divide the savings achieved in 3 years ($15,000) by the original cost ($10,000), which gives you a breakeven point of 1.5. This means to make the buydown worth it, you must live in your home for at least 1.5 years . Many experts are predicting another strong housing market in 2021. Rachel Burris is a writer covering topics of interest to present and future homeowners, as well as industry insiders.

Is It a Good Idea to Lock in My Mortgage Rate Right Now?

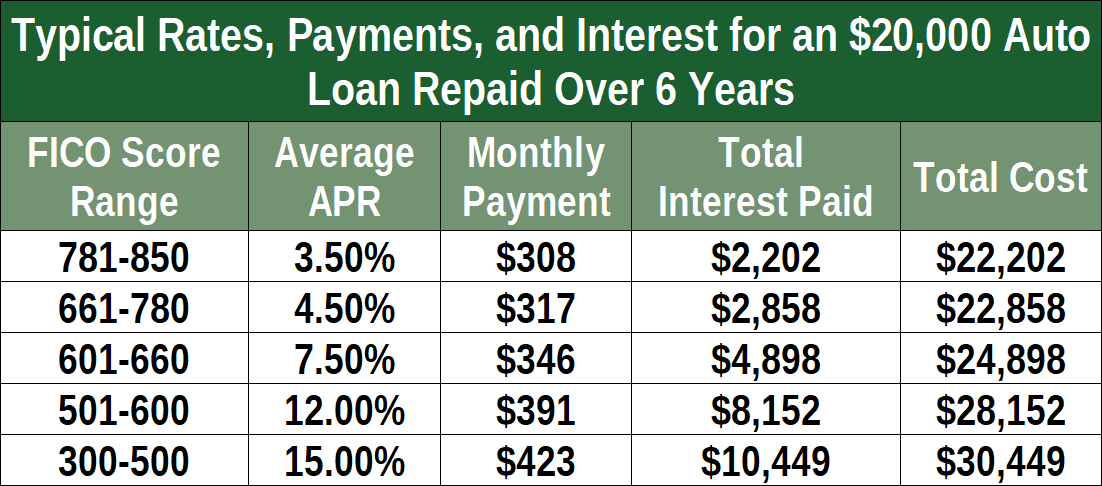

Any rate increase by the Fed will likely be passed through to auto borrowers, though it will be slightly offset by subsidized rates from manufacturers. Drury predicts that new-vehicle prices will start to ease next year as demand wanes a little. Purchasing mortgage discount points can be a viable option if you are fairly certain you will live in the house for many years. However, if you move after a couple years then paying a significant upfront fee to lock in lower rates for the life of the loan will be money wasted.

Let’s say you have a buydown that has an original cost of $10,000 and provides $15,000 in total savings over the first 3 years. On the other hand, if interest rates are currently high, you could luck out and emerge from your introductory period with a lower interest rate. If your introductory rate is ending and interest rates are still high, you may want to consider refinancing to lock in your interest rate. But instead, year one would be removed, and the permanent payment would stabilize in year three.

How have the rate hikes influenced crypto?

The lender is charging about a half point for a .125% reduction to the rate. I’d rather just take the higher rate and pay a little more to principal each month. This would also mean my home would be free and clear a lot faster.

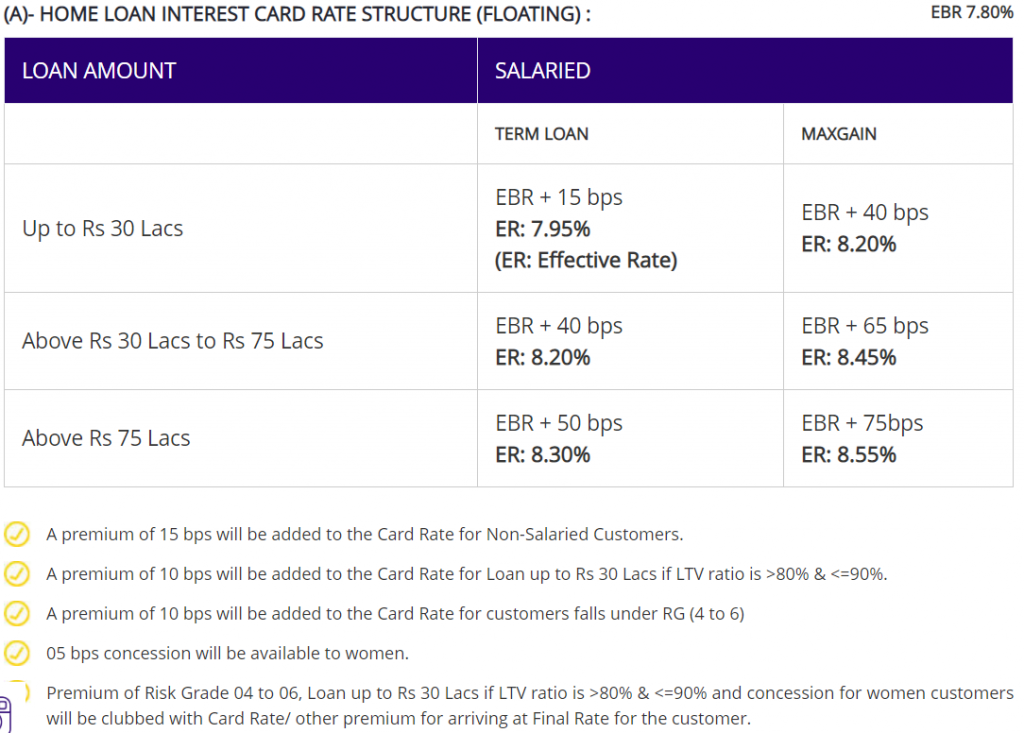

FHA loans can sometimes have a lower interest rate, by about a half a point or more, compared to a conventional loan. The interest rate on your mortgage determines what you’ll pay to borrow money from a lender, expressed as a percentage. It’s the total amount you are borrowing, including any closing costs your roll into the price of the home, less than down payment.

Americans watch mortgage rates closely, and any time rates pull back even the slightest amount, more people apply for mortgages. With rates still substantially higher than a year ago, however, applications remain stuck near the lowest level in more than two decades, according to MBA data. Back-end DTI adds your existing debts to your proposed mortgage payment. Let’s say your car payment, credit card payment and student loan payment add up to $1,050 per month. Your proposed housing payment, then, could be somewhere between 26% and 35% of your income, or $1,820 to $2,450.

Your bank statements and investment accounts will provide a larger picture of how much money you might have available to cover your mortgage. Predictions indicate that home prices will continue to rise and new home construction will continue to lag behind, putting buyers in tight housing situations for the foreseeable future. Finally, when you’re comparing rate quotes, be sure to look at the APR, not just the interest rate. The advantage of going with a broker is you do less of the work and you’ll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender who’s suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. This means time is running out for homeowners who hope to lock in a lower interest rate by refinancing.

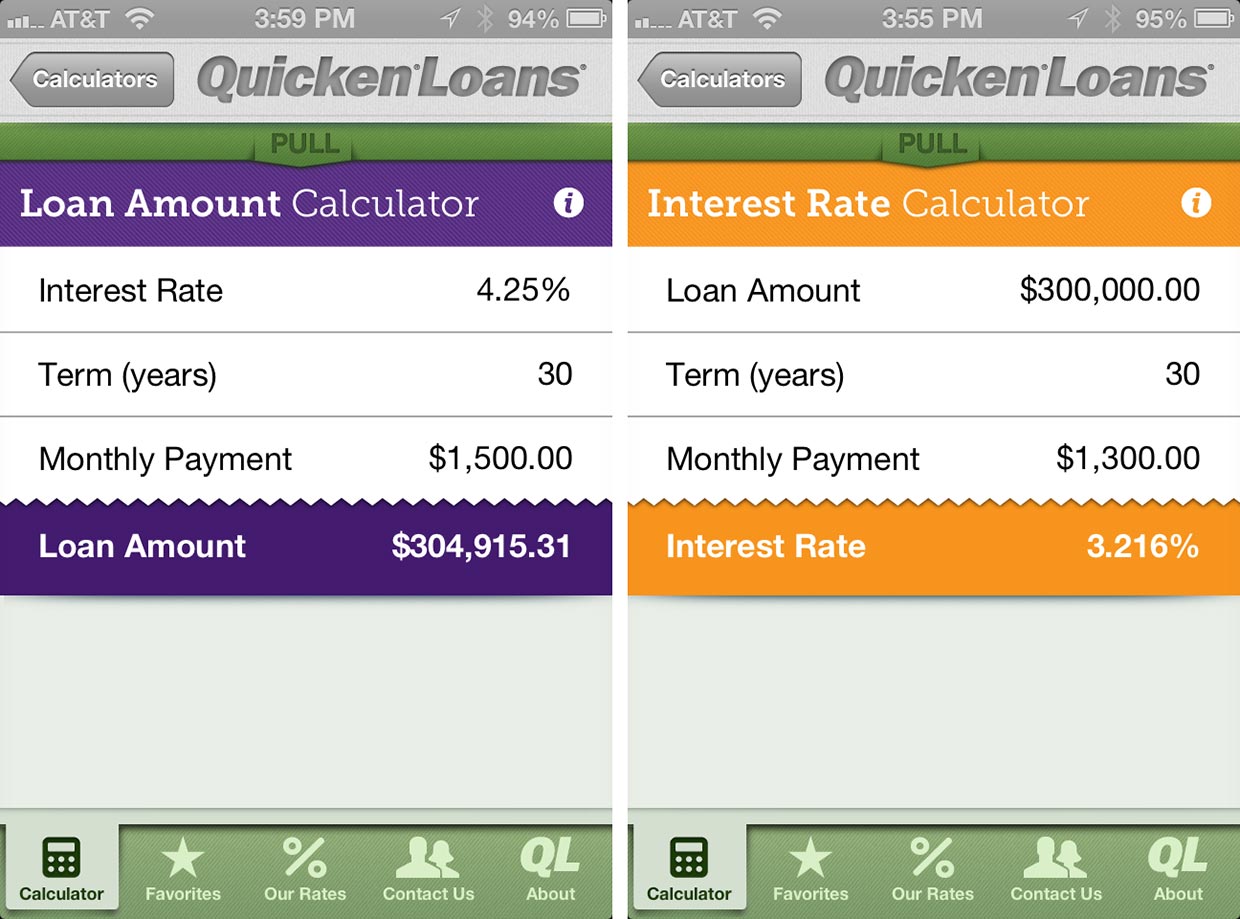

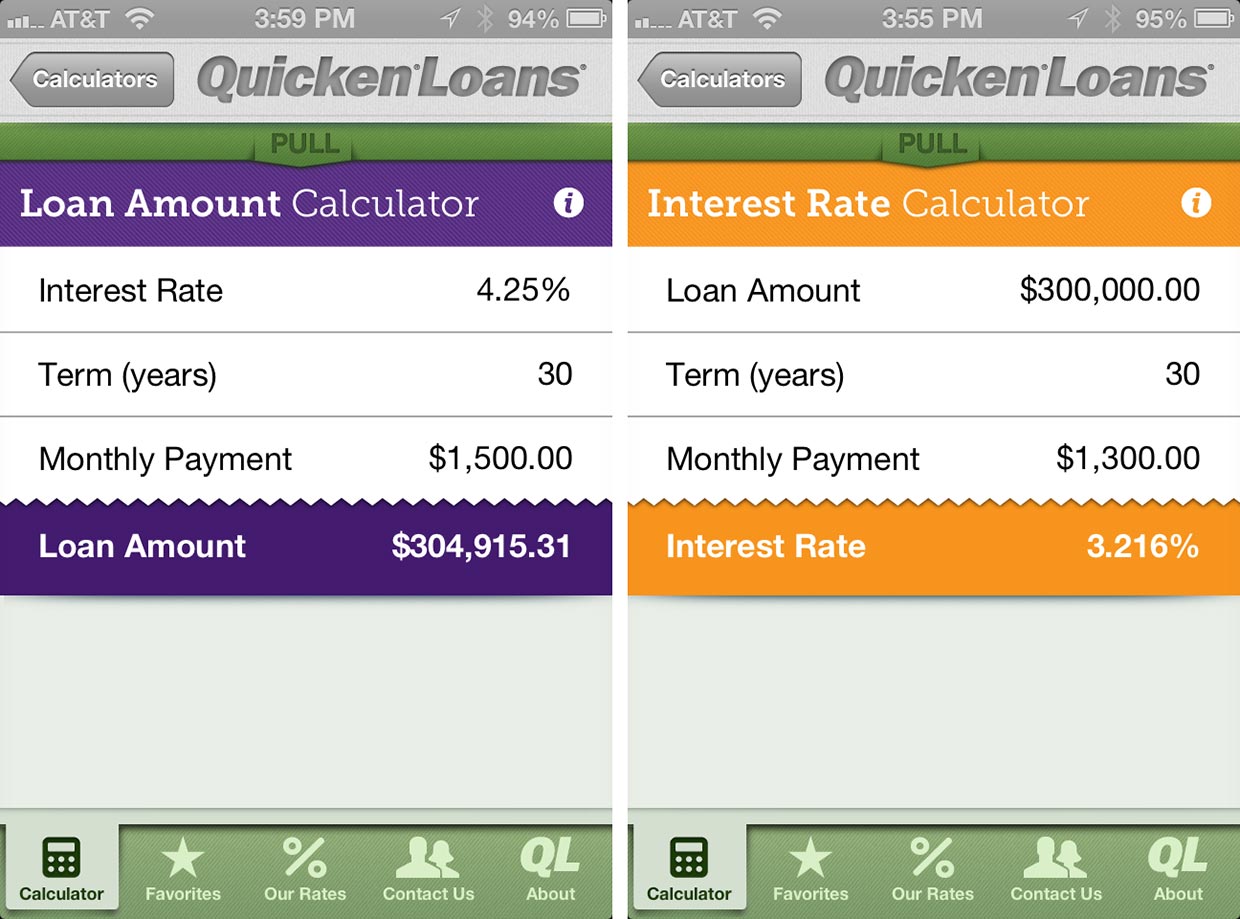

You won't be able to pay off your house as quickly and you'll pay more interest over time, but a 30-year fixed mortgage is a good option if you're looking to minimize your monthly payment. Your credit score measures your likelihood of making continuous, on-time mortgage payments. So, in general, the higher your credit score, the lower your mortgage rate.

It’s impossible to know what direction mortgage rates will go from day to day. That’s why a mortgage rate lock is such a useful tool because it protects you if rates go up. And with interest rates being relatively low right now, you should lock in your rate as soon as you can. Experts say mortgage rates have likely gone as high as they’ll go for now, with signs of improving inflation leading the way to lower rates. The Consumer Price Index showed price growth slowed in November to 7.1% year-over-year, beating the market’s expectations.

Lenders, after all, don’t just let you borrow money out of the goodness of their hearts. Adjustable-rate mortgages are generally only eligible for plans that have an initial interest rate period of at least 3 years. While the number of points charged for the buydown differs among lenders, the cost of the buydown is usually roughly equal to the amount the buyer would save in interest. In this case, the total cost of the buydown would be around $16,400. A buydown enables a buyer to pay less interest on their mortgage for 3 years after obtaining the loan. The points paid upfront reduce the interest rate by 1% for each of those first 3 years.

Edmunds says that since March, it’s up by an average of $61 to $718 for new vehicles. The average payment for used vehicles is up $22 per month to $565. The Fed’s latest increase — its seventh rate hike this year — will make it even costlier for consumers and businesses to borrow for homes, autos and other purchases. If, on the other hand, you have money to save, you’ll earn a bit more interest on it. Or if you’re starting your career, but anticipate making more money later, you may benefit from having a lower monthly payment on your mortgage loan.

I don’t invest and the money just sits in an account earning less than 1%. Might as well take a lower rate that will save my family money in just a few short years. So a buydown of .125% may cost anywhere from a half point to a full point, depending on your starting point.

Typically, borrowers with higher FICO scores, lower debt-to-income ratios and a larger down payment can lock in lower rates. Treasury bond yields, rising inflation and the Federal Reserve’s monetary policy indirectly influence mortgage rates. As inflation increases, the Fed reacts by applying more aggressive monetary policy, which invariably leads to higher mortgage rates.

Comments

Post a Comment