Current Interest Rates

Table of Content

Mortgage rates don’t always move in tandem with the Fed’s benchmark rate. They instead tend to track the yield on the 10-year Treasury note. Anyone borrowing money to make a large purchase, such as a home, car or large appliance, will take a hit, according to Scott Hoyt, an analyst with Moody’s Analytics. He says APRA should be brought back into the Reserve Bank so regulatory and monetary policy is not set in isolation. "There is a real risk in this cycle in 2023, that we see tens of thousands of people having to get out of properties and can no longer afford their mortgages." "These record low interest rates, not only no longer exist in the market in late 2022, but are unlikely to exist again."

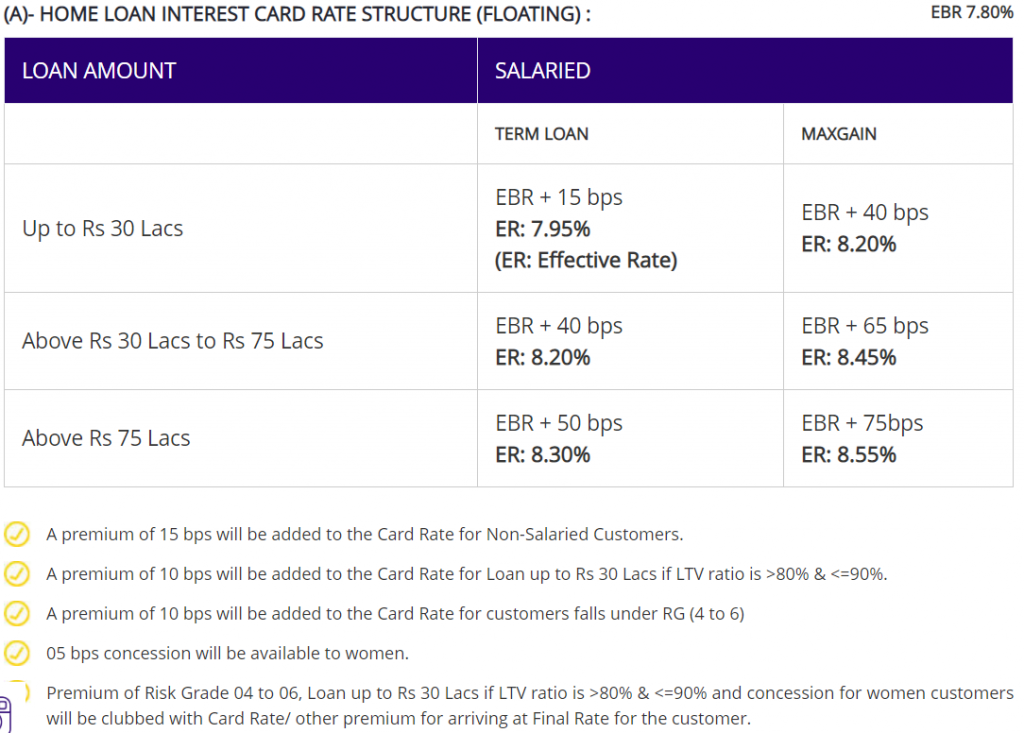

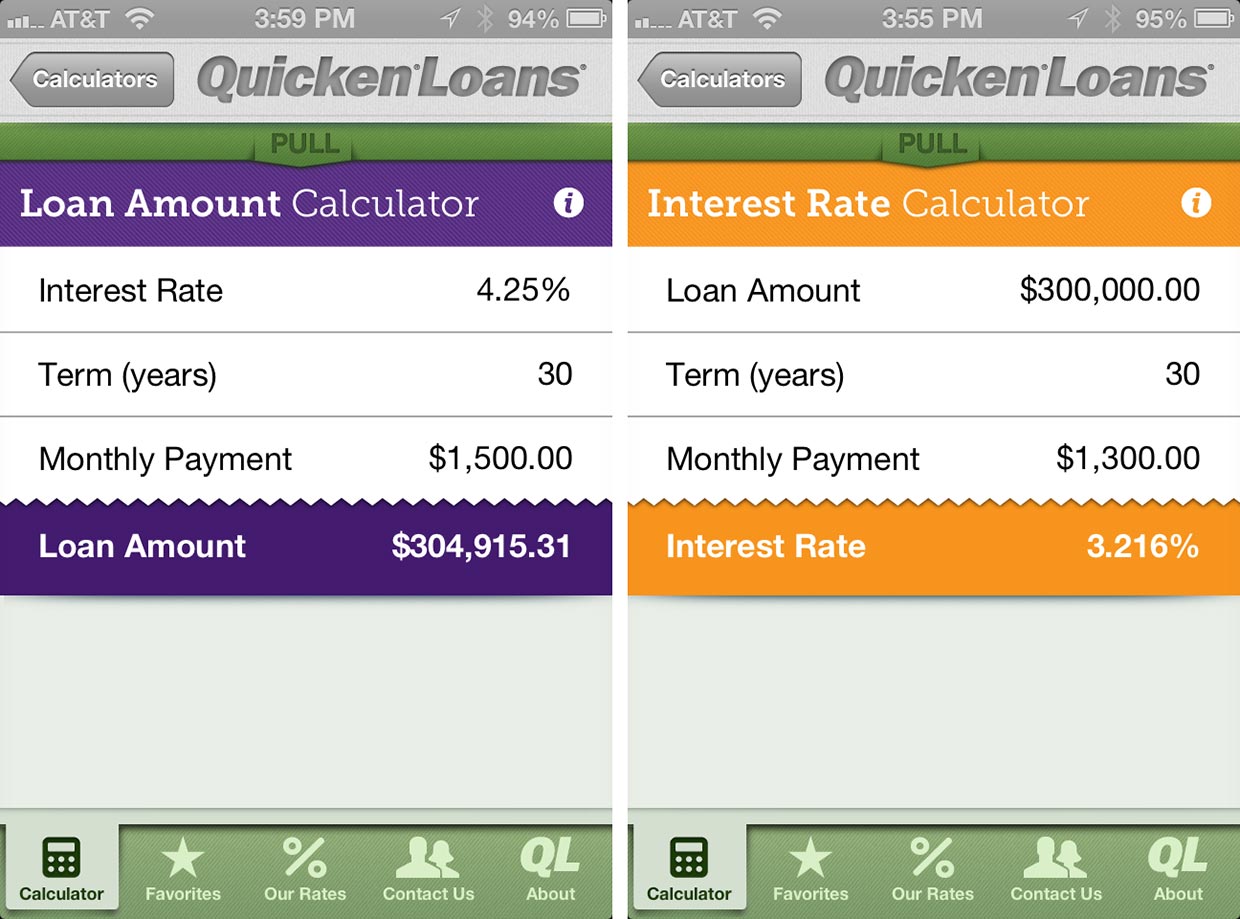

Industry experts forecast the average 30-year fixed rate mortgage to settle around 4% by the end of 2022. Pay points – If you expect to stay in the home long-term and won’t refinance for at least five years, you can choose to pay an additional fee, known as a point, to trim your interest rate. Each point typically costs 1 percent of the loan amount and reduces your rate by 0.25 percentage points. Consider a low-credit mortgage – If your credit score isn’t as high as you’d like it to be, consider getting an FHA loan.

How Much Does 1 Point Lower Your Interest Rate?

Mortgage loans allow buyers to break up their payments over a set number of years, paying an agreed amount of interest. The benchmark fixed rate on 30-year mortgages now sits at 6.5 percent, down from last month’s levels, according to Bankrate’s national survey of large lenders. The Federal Reserve raised rates at its December meeting, the seventh straight increase in 2022 — although this time by just half a point. Borrowers can get preapproved for a mortgage by meeting the lender’s minimum qualifications for the type of home loan you’re interested in. For example, a conventional mortgage usually has higher credit score and down payment requirements than government loans, such as Federal Housing Administration and Veterans Affairs mortgages.

Experts are forecasting that the 30-year, fixed-mortgage rate will vary from 4.8% to 5.5% by the end of 2022. Check your eligibility and the latest interest rates to see if locking in a mortgage and buying a home is right for you. With housing costs growing at such a rapid rate, inflation reached 6.8% in November and hit its highest level since 1982.

How Do I Qualify for the Lowest Mortgage Rate?

Closing costs can be anywhere between 3-6% of the loan amount, and include fees such as loan origination charges, prepaid interest and property taxes. One way to reduce your out of pocket costs, if to accept a higher interest rate in exchange for lender credits. This strategy can save you money in the short-term, so it’s worth looking into if there is a chance you’ll be selling the home or refinancing in five to eight years.

If conditions are choppy, and interest rates are likely to at least stay the same, if not rise, it may be smart to lock in a rate that works with your budget and seems fair to you. When interest rates rise, reflecting changes in the economy and financial markets, so too do mortgage rates—and vice versa. Consider options from as many mortgage lenders as possible to find the best deal for you. Prospective buyers have saved more than $1,500 over a loan’s term by getting two quotes from lenders, and saved roughly $3,000 when they sought five quotes, according to Freddie Mac. Demand for mortgages can also affect rates, pushing it higher as available capital for lending tightens.

Are there limits to mortgage buydowns?

Lending has become increasingly more costly for homeowners and borrowers alike as mortgage rates continue to rise. Mortgage rates jumped 1.5 percentage points during the first three months of the year, the biggest quarterly climb in 28 years. Apart from the interest rate, factors including closing costs, fees, discount points and taxes might also affect the cost of your home.

Jeffrey L. Beal, president of Real Estate Solutions, has 40 years' experience in multiple phases of the real estate industry. The Federal Open Market Committee meets every six weeks and could change the Fed’s benchmark rate at any meeting. With inflation at levels not seen in 40 years, most economists expect multiple rate hikes this year. They have trended upward in 2022, bouncing back from the record lows of the pandemic era.

Contents

Then, they increase or adjust to the current rate after fixed rate period has elapsed. These rates can be an entire point lower than 30 year fixed rates. Therefore, there may be significant savings in terms of interest paid to the lender. Some common hybrid ARMs are 1 year fixed, 1 year adjustable rates (1/1); 5 years fixed, 1 year adjustable (5/1); and 7 years fixed, 1 year adjustable (7/1). The adjustable rates will be based upon the federal rate when the fixed term elapses. These loans are also appealing to investors or home buyers who plan to sell in a short period of time.

But mortgage rates are unlikely to go much higher than 7%, according to Bank of America managing director Jeana Curro, who tracks the housing market for the bank. At the moment, Curro said, lenders are demanding a higher premium because of the volatility financial markets have been experiencing, and the price uncertainty that such volatility causes. As of May of this year, the average median price of a home in the U.S. climbed to $414,200, the NAR data shows. Accounting for the higher mortgage rates, which reached a 6.7% average this week, the monthly payment would be about $1,842 — an increase of 53%. In addition to your principal and interest payments, a monthly mortgage payment may also include several fees, like private mortgage insurance , taxes and homeowners association fees. If interest rate cost is an important factor for you, you might also consider an adjustable-rate mortgage .

The cost for each discount point depends entirely on the amount you, as the borrower, take out on the loan. Each point that a borrower pays is equivalent to 1% of the loan amount. Read on to learn what a buydown is, how it works and whether it’s right for you. Finding the perfect home for your family’s needs can be a tough chore — and when you finally find it, you don’t want to be stymied worrying about interest rates. Buy the home at the best interest rate available and settle in to enjoy it.

Mortgage rates have increased fairly consistently since the start of 2022, following in the wake of a series of interest rate hikes by the Federal Reserve. Interest rates are dynamic and unpredictable -- at least on a daily or weekly basis -- and they respond to a wide variety of economic factors. But the Fed's actions, designed to mitigate the high rate of inflation, are having an unmistakable impact on mortgage rates.

All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. Federal Reserve Chairman Jerome Powell speaks during a press conference after the central bank raises interest rates on Dec. 14. It looks increasingly unlikely that rates will come down anytime soon. On Wednesday, the Fed signaled that it will raise its rate as high as roughly 5.1% early next year — and keep it there for the rest of 2023.

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team.

Comments

Post a Comment